The recent Fortune article Don’t mess with the penny lobby brings up the cost it takes to produce a single penny:

It costs 2.4 cents to make each penny.

I’d heard previous statements that it costs more than a penny to make a penny, but this was the first time I’d seen a specific figure. Unfortunately there was no link to reference where that number came from, so I went looking for supporting data. I found it on the United States Mint Annual Report page. Specifically the 2011 Annual Report (PDF), page 11. It breaks down the cost of a 1 cent piece (penny) as:

| Cost of Goods Sold | $ 0.0197 |

| Sales, General & Administrative | $ 0.0041 |

| Distribution to FRB | $ 0.0003 |

| Total Unit Cost | $ 0.0241 |

Making the total cost for a $0.01 piece $0.0241. Not hard to see how the math works against us there. But the Fortune article also made this claim, that I hadn’t heard before:

It also costs more than a nickel to make a nickel, but there’s no movement to discontinue that coin.

So back to page 11 of the 2011 Annual Report for the total cost to produce a nickel:

| Cost of Goods Sold | $ 0.0938 |

| Sales, General & Administrative | $ 0.0176 |

| Distribution to FRB | $ 0.0004 |

| Total Unit Cost | $ 0.1118 |

The cost overrun of a five cent piece is in the same ball park as the one cent piece, with a cost that is 2.236 times the value of the coin. If your reason for wanting to ditch the penny is the crazy cost to value difference then the nickel needs to go as well.

Thankfully the total cost to make a dime ( $ 0.0565 ), quarter ( $ 0.1114 ), and one dollar coin ( $ 0.1803 ) are well below their stated value. But how long would that be true? This got me wondering how long the penny and nickel have been upside down in value. I started going through earlier U.S. Mint Annual Reports to see what could be learned from the cost trends. Lucky for us their site provides data on the costs going back to 2000.

To simplify the issue some what I choose to focus only on the cost of goods sold (COGS) for each coin. I did this for a couple of reasons. First, I felt like it was better to focus on the specific issue of the production costs, instead including administrative and distribution costs. Second, for some years there is no data for administrative costs, making a direct comparison on the total cost unreliable.

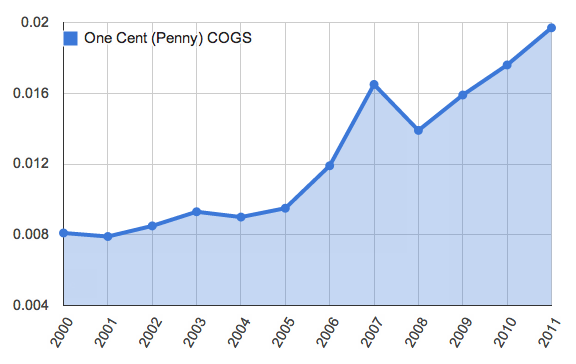

Here is the COGS history for the penny:

| Year | One Cent (Penny) COGS |

|---|---|

| 2000 | 0.0081 |

| 2001 | 0.0079 |

| 2002 | 0.0085 |

| 2003 | 0.0093 |

| 2004 | 0.0090 |

| 2005 | 0.0095 |

| 2006 | 0.0119 |

| 2007 | 0.0165 |

| 2008 | 0.0139 |

| 2009 | 0.0159 |

| 2010 | 0.0176 |

| 2011 | 0.0197 |

The same data in graph form:

It was 2006 when the COGS for a penny went above one cent, to $0.0119.

Now for the nickel:

| Year | Five Cent (Nickel) COGS |

|---|---|

| 2000 | 0.0313 |

| 2001 | 0.0329 |

| 2002 | 0.0306 |

| 2003 | 0.0346 |

| 2004 | 0.0446 |

| 2005 | 0.0478 |

| 2006 | 0.0592 |

| 2007 | 0.0949 |

| 2008 | 0.0877 |

| 2009 | 0.0579 |

| 2010 | 0.0916 |

| 2011 | 0.0938 |

And the graph:

I double checked that I had the 2009 number correct because it was such a large dip. That 0.0579 was reported in multiple annual reports, so I’m going to take it as correct. It does leave me wondering why the production cost dropped so much for that one year.

Just like the penny it was 2006 when the nickel COGS, 0.0592, exceeded the value of the coin. And since 2006 their upside down situation has continued to go from bad to worse.

Looking over the production costs for the penny and nickel since 2000 they’ve both gone up in cost dramatically. The penny costs 2.43 times more to produce in 2011 than it did in 2000. The cost of a nickel has gone up 2.99 times during the same time frame.

Focusing only on costs, the penny and nickel really don’t have a leg to stand on. Perhaps instead getting rid of just the penny, rounding to the nearly five cents, we should stop using nickels too. That would leave us with rounding to the nearest ten cents, which gives me an idea.

What if, instead of getting rid of the coins, we took a one time across the board reduction in value of 10% for everything? Move the decimal place to the left for everything on the same day, say 1 Jan 2015. Your $200,000 mortgage would then only be $20,000. The $10,000 in your savings account would become $1,000. And the $0.0197 cost for a penny would become $0.00197.

Instead of getting rid of pennies and nickels because they are basically worthless and cost more to produce than their stated value, they’d instantly become valuable again. Practical? Perhaps not, but in some ways simpler than adjusting everything to the nearest five or ten cents.